Business

Africa’s Fintech Infrastructure Gets Boost! Flutterwave Acquires Nigerian Open Banking Startup Mono in $40m Deal

Africa’s largest fintech company, Flutterwave, has acquired a significant stake in Nigerian open banking startup Mono in a deal valued at about $40 million, marking one of the most notable fintech transactions on the continent in recent years.

The acquisition, first reported by African Business Insider, brings together two influential players in Africa’s financial technology ecosystem and underscores growing momentum around open banking as a foundation for the next phase of digital finance across the continent.

Flutterwave, which operates payment services across more than 30 African countries, said the deal aligns with its long-term ambition to build a more connected and interoperable financial system. The company views open banking as a core pillar of future growth, particularly as African markets move beyond traditional card-based payments toward data-driven and account-to-account financial services.

Mono, a pioneer of open banking infrastructure in Nigeria with expanding operations across Africa, provides API-driven access to financial data, identity verification, and direct bank-to-bank payments. These capabilities are increasingly critical as businesses, regulators, and consumers demand more secure, transparent, and trusted financial services.

Under the terms of the agreement, Mono will continue to operate as an independent product, with no changes to its leadership, team, or day-to-day operations. Flutterwave’s stake is structured to support strategic alignment rather than operational control, allowing Mono to maintain its pace of innovation while contributing its technology to Flutterwave’s broader payments ecosystem.

Flutterwave founder and chief executive Olugbenga Agboola said the acquisition reflects a broader rethinking of how Africa’s financial infrastructure must evolve.

“Payments, data, and trust cannot exist in silos,” Agboola said. “Open banking provides the connective tissue, and Mono has built critical infrastructure in this space.” He added that the deal expands what is possible for businesses operating across African markets while remaining firmly grounded in security and regulatory compliance.

By integrating Mono’s open banking APIs, Flutterwave expects faster merchant onboarding, improved customer verification, reduced fraud, and more seamless account-to-account payments. The company is also exploring longer-term opportunities in alternative payment methods, including open banking-enabled stablecoin use cases, as demand grows for locally relevant and authenticated payment flows.

Mono founder and chief executive Abdulhamid Hassan said the acquisition builds on an existing relationship between the two companies, which began with a partnership in 2021.

“Since our first partnership with Flutterwave, we have seen the power of a coordinated effort toward unlocking Africa’s open banking potential,” Hassan said.

According to him, combining Mono’s data and identity capabilities with Flutterwave’s scale and global reach creates a more comprehensive and defensible infrastructure layer for the next generation of African fintech companies.

The transaction also represents a strong exit for Mono’s investors, with some early backers reportedly achieving returns of up to 20 times their initial investment. Analysts say this signals increasing maturity in Africa’s startup ecosystem, where large-scale exits have historically been limited.

The deal was advised by Nichole Yembra of The Chrysalis Advisors Africa and comes at a time when regulators, developers, and businesses across the continent are pushing for financial systems that are open by design, interoperable, and built on trust.

For Ghana and other fast-growing fintech markets in Africa, the Flutterwave–Mono deal highlights how cross-border infrastructure partnerships are reshaping digital finance and positioning African companies to compete more effectively on the global stage.

Business

Ghana’s Mega Infrastructure Push: 10 Game-Changing Projects Set to Transform the Country in 2026

Accra, Ghana – March 3, 2026 – Ghana is in the midst of one of the most ambitious infrastructure drives in its history, with ten massive projects—ranging from railways and highways to solar parks, gas processing plants, and a landmark petroleum hub—poised to reshape transportation, energy, trade, and economic opportunity across the country and West Africa.

A recent viral video breakdown highlights these “megaprojects” as the backbone of Ghana’s development agenda under President John Dramani Mahama’s administration, emphasizing their role in modernizing mobility, boosting industrial output, ensuring energy security, and positioning Ghana as a regional economic powerhouse.

Top 10 Megaprojects Driving Ghana Forward

1 Big Push Roads Network

The flagship of Ghana’s GH¢30.8 billion infrastructure plan, this nationwide programme includes over 32 major road projects—dual carriageways, bridges, and interchanges—along critical corridors such as Accra–Kumasi, Tema–Aflao, and Cape Coast–Takoradi. Sod-cutting ceremonies began in 2025, with rapid progress expected in 2026. The network aims to slash congestion, cut transport times, lower logistics costs, and unlock trade, agriculture, and manufacturing growth.

2 Ghana Petroleum Hub

A $60 billion mega-development in the Jomoro Municipality near the western border, the hub integrates exploration, refining, storage, and export facilities. Groundwork accelerates in 2026, promising thousands of jobs, foreign investment, and a shift from net importer to regional energy leader.

3 Big Push Road Interchanges

Eight major interchanges along the Accra–Kumasi corridor target chronic urban congestion, supporting the 24-Hour Economy by improving traffic flow, reducing delays, and boosting productivity for commuters and businesses.

4 Trans-ECOWAS Railway

A proposed 530 km standard-gauge corridor linking Ghana’s eastern and western borders to Togo and Côte d’Ivoire. Feasibility studies continue, with potential construction start in 2026, aiming to revolutionize regional trade and connectivity.

5 Dawa Solar Park Phase 1

Ground broken in November 2025, this 100 MW solar facility in the Dawa Industrial Enclave near Accra is set for completion by December 2026. Phase 2 will double capacity to 200 MW, offering industrial users a 10% energy discount and significantly cutting carbon emissions.

6 OCTP Gas Processing Upgrade

Offshore Cape Three Points (OCTP) facility expanded to 270 million standard cubic feet per day in 2025, supplying ~70% of Ghana’s domestic gas and ~34% of electricity. The upgrade strengthens energy security and reduces reliance on imported fuels.

7 Amer Power Plant Relocation

Relocation of the Amer plant from Aboadze to Anwomaso in the Ashanti Region (ongoing since 2024) optimizes distribution, reduces transmission losses, and improves reliability for northern regions.

8 Bui Hydro-Solar Hybrid Phases 2 & 3

Adding 150 MW of solar to the existing Bui hydroelectric plant in the Bono Region, this hybrid expansion enhances renewable output, preserves water resources, and provides stable power even during low-rainfall periods.

9 Wiawso–Sankore Road

A 195 km highway across Bono East, Savannah, and Upper West regions, divided into seven lots for faster construction. Part of the Big Push initiative, it will accelerate agri-freight, connect regional capitals, and open rural markets.

10 Kojokrom–Manso Railway

A standard-gauge mineral freight line in the Western Region, 16% complete by 2023 and targeted for full operation by May 2026. Designed to move bulk cargo (gold, bauxite, manganese) efficiently to ports, reducing road congestion and transport costs.

These projects collectively aim to modernize Ghana’s transport backbone, secure reliable energy, integrate renewables, boost agricultural and industrial value chains, and position the country as a West African trade and logistics hub. Many are already under construction or in advanced planning, with 2026 marking a pivotal year of acceleration.

Business

Ghanaians Warned to Brace for Possible Fuel Price Hikes Amid Escalating Middle East Conflict

Accra, Ghana – March 3, 2026 – Ghanaian motorists and households have been cautioned to prepare for potential increases in petroleum product prices as the ongoing US-Israel-Iran conflict continues to destabilise global energy markets, according to industry leaders.

Dr. Riverson Oppong, Chief Executive Officer of the Chamber of Oil Marketing Companies (COMAC), told the Business & Financial Times (B&FT) that while Ghana currently faces no immediate risk of fuel shortages, prolonged geopolitical instability in the Middle East will inevitably drive up costs for consumers.

“The impact on Ghana will obviously be reflected in rising prices. There will certainly be a surge,” Dr. Oppong said.

He explained that Ghana remains a net importer of refined petroleum products, sourcing more than 60% of its domestic needs externally despite local production from the Jubilee and TEN fields and partial refining at the Tema Oil Refinery (TOR).

The warning follows the opening of the first pricing window for March (March 1–15, 2026), which already recorded marginal increases: petrol projected to rise 2.89% to approximately GH¢12.04 per litre, diesel up 0.86% to GH¢13.22 per litre, while LPG is forecast to dip slightly to GH¢13.87 per kg. The National Petroleum Authority (NPA) confirmed the price floor adjustments, with petrol now at a minimum of GH¢10.46 per litre (up from GH¢10.24) and diesel at GH¢11.42 per litre.

Dr. Oppong and other experts attribute the upward pressure to Brent crude’s surge past US$80 per barrel in early March trading—spiking more than 10%—driven by fears of supply disruptions through the Strait of Hormuz, through which about 20% of global crude flows. Recent attacks by Iran’s Islamic Revolutionary Guard Corps on oil tankers in the Gulf, combined with the shutdown of a major refinery in Qatar (capacity 550,000 barrels/day) and damage to infrastructure in the UAE, Saudi Arabia, and Kuwait, have tightened supply expectations.

Justice Ohene-Akoto, CEO of the African Sustainable Energy Centre, warned that four additional price hikes could occur in the coming weeks if tensions persist. He noted that even regional refineries like Dangote in Nigeria are unlikely to offer discounted prices to neighbours, meaning premium global rates would still apply.

Both leaders pointed to Ghana’s limited refining and storage capacity as a structural vulnerability. Dr. Oppong lamented that a fully operational large-scale refinery could transform Ghana into a net exporter, earning foreign exchange and ensuring availability. He urged the government to consider temporary relief measures, such as suspending or reducing the Price Stabilisation and Recovery Levy (PSRL), to cushion consumers from the expected cost surge.

The National Petroleum Authority has reassured the public that operational buffers—regular imports, daily discharges, TOR output, and Atuabo LPG production—will prevent shortages, but affordability remains the critical challenge. With Brent crude potentially climbing toward US$90 if the Strait of Hormuz faces further threats, Ghana’s import-dependent fuel market remains highly exposed.

Industry stakeholders and consumers alike are watching global developments closely, as any prolonged disruption could quickly reverse recent gains in inflation control and cedi stability.

Business

OPEC+ Boosts Oil Output as Markets Reel from US-Israel Strikes That Killed Iran’s Khamenei

London / Accra – March 1, 2026 – OPEC+ has agreed to increase oil production by 206,000 barrels per day starting in April, a modest move aimed at calming volatile global oil markets following the dramatic escalation of the Israel-Iran conflict, including joint US-Israeli air strikes that killed Iran’s Supreme Leader Ayatollah Ali Khamenei and triggered widespread retaliatory missile barrages across the Gulf.

In its latest dispatch, the Financial Times reports that the decision—slightly above market expectations but far below levels needed to offset potential supply disruptions—was made amid fears that Iran’s threats to close the Strait of Hormuz could choke off 20% of the world’s seaborne oil trade.

With Khamenei confirmed dead by Iranian state television, the power vacuum in Tehran has intensified uncertainty, with no successor yet named and President Masoud Pezeshkian vowing “vengeance and revenge.”

The strikes and counter-strikes have already caused significant disruptions: shipping through the Strait of Hormuz has slowed to a near standstill as insurers warned of policy cancellations and premium surges; a Saudi Aramco-chartered tanker (MKD Vyom) suffered an explosion and flooding off Iran’s coast; and another vessel (Skylight) was hit, injuring four crew.

Major Japanese shipping lines halted Gulf passages, while CMA CGM suspended Suez Canal transits, diverting vessels around Africa’s Cape of Good Hope—adding weeks and millions in costs to global trade routes.

Oil prices have spiked amid the chaos, with analysts warning that even OPEC+’s additional barrels “serve little purpose if there are no serviceable sea lanes,” as noted by Helima Croft of RBC Capital Markets and Jorge Leon of Rystad Energy. Middle East stock markets plunged—Saudi Arabia’s TASI fell nearly 5% before partial recovery, Egypt’s EGX 30 dropped nearly 6%—while European gas contracts are expected to rise 25%+ due to LNG supply risks from Qatar and the UAE.

The conflict has extended beyond Iran and Israel: US bases in Iraq and the Gulf were targeted; ports in Dubai and Oman sustained damage; Bahrain’s navy base and airport were hit; and GPS jamming affected over 1,100 vessels, raising sanctions compliance concerns for banks and insurers.

For emerging markets like those in Africa—including Ghana—the fallout could be severe.

Higher oil and LNG prices would inflate import bills, push up fuel and electricity costs, fuel inflation, and pressure currencies already strained by global volatility. Shipping diversions via the Cape of Good Hope could raise freight rates for African exports and imports, while broader energy market instability risks derailing post-pandemic recovery in oil-importing nations.

OPEC+’s output increase is seen as symbolic rather than substantive in the face of geopolitical risk. As one Barclays strategist put it, investors may be “underpricing a scenario where containment fails.”

-

News15 hours ago

News15 hours agoGhana Gears Up for Vibrant 69th Independence Day Celebrations: Parades, Plays, Poetry, and Heritage in Focus

-

Tourism13 hours ago

Tourism13 hours agoEmirates Resumes Limited Flights from Dubai as Middle East Airspace Slowly Reopens Amid Ongoing Conflict

-

Ghana News16 hours ago

Ghana News16 hours agoNewspaper Headlines Today: Tuesday, March 3, 2026

-

Ghana News16 hours ago

Ghana News16 hours agoAyawaso East By-Election Results Trickle in, ECG Audits Fast-Reading Meters, and Other Trending Topics in Ghana (March 3, 2026)

-

Ghana News2 days ago

Ghana News2 days agoCourt Slaps Barker-Vormawor with GH₵5m for Defaming Kan Dapaah and Other Trending Topics in Ghana (March 2, 2026)

-

Fashion & Style6 hours ago

Fashion & Style6 hours agoThe New Wave of “Afro-Minimalism”: Redefining Luxury Beyond the Print

-

Ghana News6 hours ago

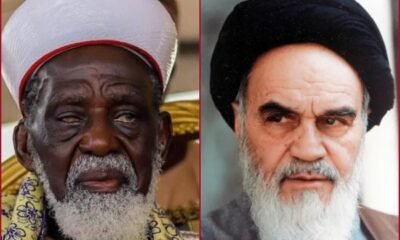

Ghana News6 hours agoGhana’s Top Muslim Leader Condemns Khamenei Assassination, Calls for New World Order Based on ‘Right Over Might’

-

Commentary12 hours ago

Commentary12 hours agoAt a glance: US‑Israel attack on Iran